PRIVATE EQUITY

Our Strategy

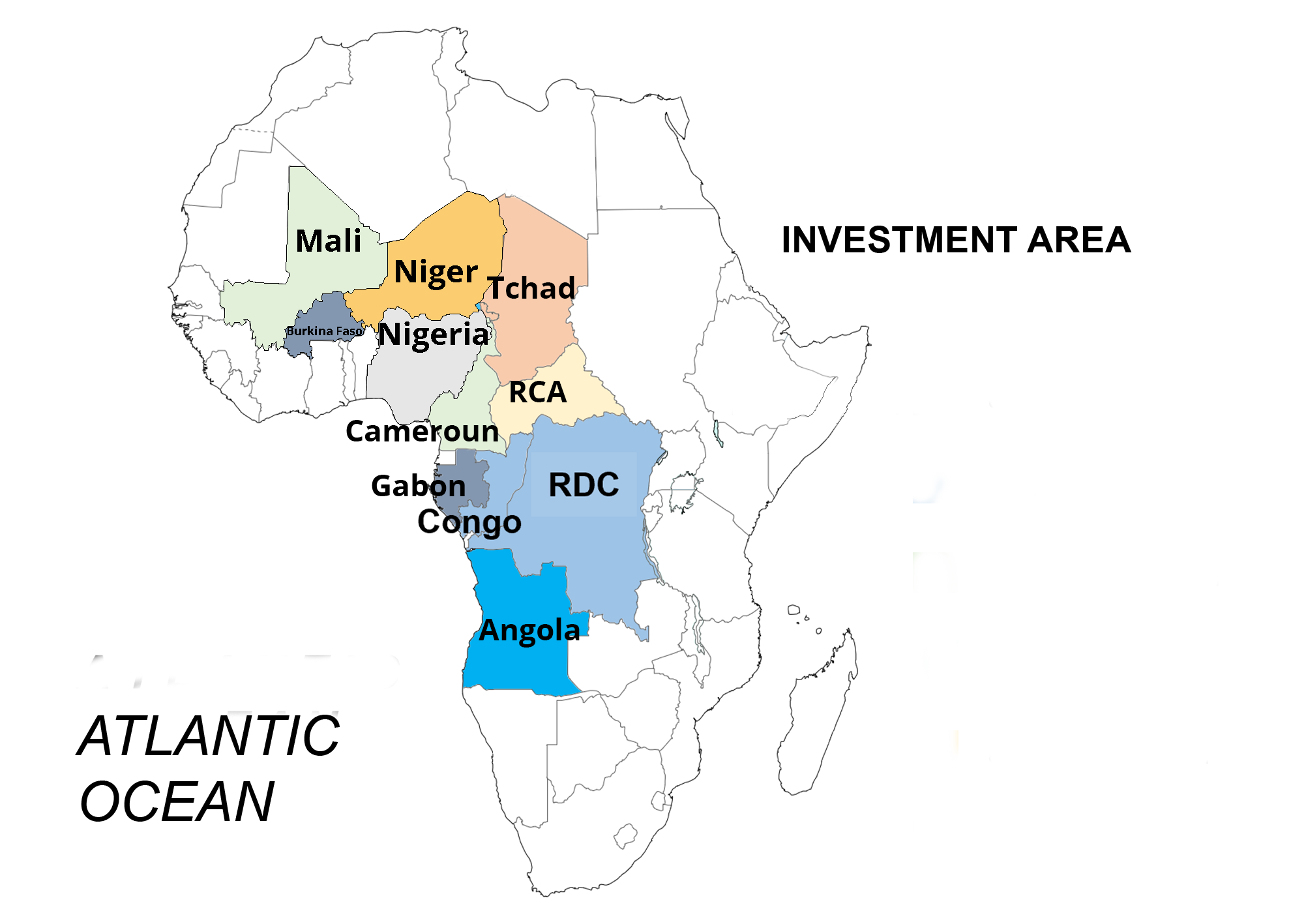

We invest in starter, growth and distress companies in Africa.

Investment Focus

Buy Out :

G.Mercury & Cie focuses on mid-market buyout opportunities across Africa. We lead our own investments that have been identified through our network and look to partner with strong management teams to build great companies and create long term value.

In Africa, the dynamic combination of emerging industry and the demographic trajectory mean the strategies used by private equity firms to create value often focus on project finance and structured finance to support sustainable expansion. These strategies may support the company to develop and capture more of the value chain of an industry, or to capitalise on increasing demand.

Fields

We have decided to invest in the following sectors of activity, due to the identified needs and the growing population.

Our Approach

All of our successful investments are built on a foundation of strong relationships, deep industry expertise, and a commitment to operational excellence.

Our investment approach is centered on these core principles, which we believe allow us to generate superior returns for our investors while also contributing to the success of our portfolio companies.

- Investment sourcing : Identifying and evaluating potential investment opportunities.

- Due diligence : Conducting in-depth research and analysis of potential investments to determine their potential for success.

- Deal structuring: Negotiating and structuring deals with companies and other investors.

- Portfolio management: Managing the firm's portfolio of investments, including providing support and guidance to portfolio companies.

- Exit planning: Planning and executing the exit strategy for portfolio companies, such as through an initial public offering or a sale to another company.

- Fundraising: Raising capital from investors to fund the firm's activities.

- Operations team: Managing day to day activities.

- Risk management: Identifying and mitigating potential risks associated with the firm's investments.

Our Philisophy

We believe that our investments should have a positive impact on the communities in which we operate. Our Principles of Partnership are just a few reasins why owners and entrepreuneurs seek to work with us.

Environmental, Social, and Governance (ESG)

G.Mercury & Cie is committed to integrating Environmental, Social, and Governance (ESG) considerations into our investment process. We believe that this approach not only aligns with our values and mission but also has the potential to drive long-term value creation for our investors and portfolio companies.

Environmental Considerations:

We recognize the impact that our investments can have on the environment and are committed to minimizing this impact wherever possible. We actively seek out companies that have strong environmental practices and are focused on reducing their carbon footprint. We also work closely with our portfolio companies to identify opportunities for improving their environmental performance and reducing waste.

Governance Considerations:

We believe that strong corporate governance is essential for creating long-term value and minimizing risks. We seek out companies that have strong governance practices and are committed to transparency, accountability, and ethical behavior.

Social Considerations:

We actively seek out companies that have a strong commitment to social responsibility and are focused on creating a positive impact on their employees, customers, and local communities. All of our portofolio Companies work in their social impact, such as through initiatives that support employee well-being, diversity and inclusion, and community engagement.